There Is No Such Thing as Socially Responsible Investing

October 29, 2016 Eric Ellis

Investors should focus on one thing: will this opportunity make money? Trying to complicate the issue by screening out companies that do not act in ways harmful to society or the planet is an impossible task.

I have heard many people talk over the years about how they do not want their money to be invested in corporations that participate in harmful behavior. There are money management firms who will sell these people shares in what they deem to be socially responsible investment funds.

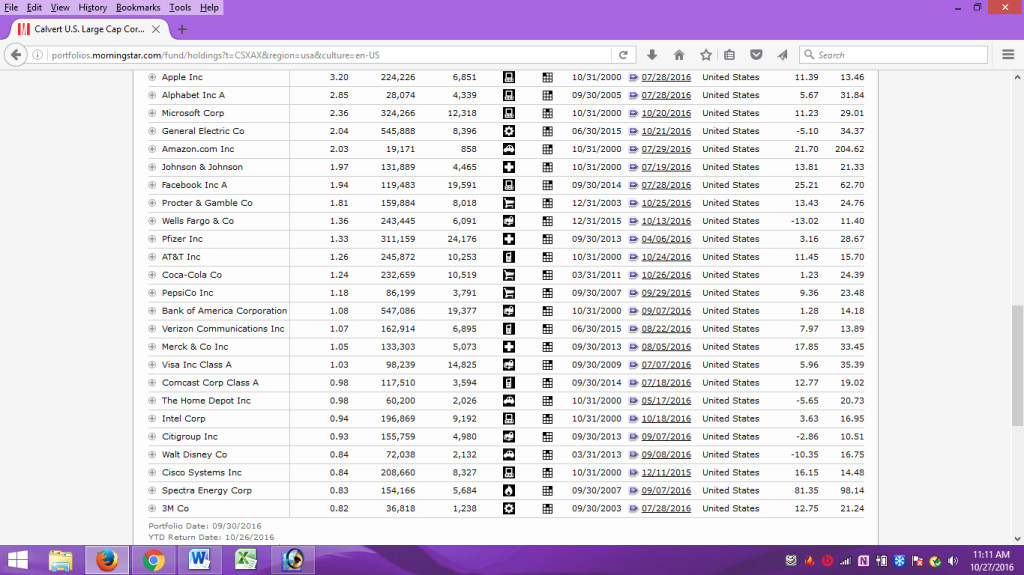

The Calvert U.S. Large Cap Core Responsible Index Fund (CSXAX) can be used to illustrate. The fund claims to assess investments based on each security’s material environmental, social and governance performance. That sounds good. But let us take a look at a current listing of the top twenty-five holdings from Morningstar (click to enlarge):

Right away we see a red flag. They own shares of Wells Fargo. That bank’s CEO just resigned amidst a massive scandal surrounding the opening of new customer accounts without the customers’ knowledge. How socially responsible is that?

Pick any name off this list and there is liable to be dirty laundry. Johnson and Johnson is currently engaged in a controversy over cover up of cancerous products. Apple has a large number of Chinese workers. While they do their best to put a good PR face on it, reports periodically surface regarding poor factory conditions. General Electric has been accused of paying bribes for business in a Brazilian corruption scandal. Pfizer, Merck and 3M have all had issues with chemical storage or disposal in recent times. If chemical incidents like this are happening in the highly regulated United States imagine what probably happens in lightly regulated overseas facilities. Amazon was the subject of a New York Times investigation into brutal workplace culture.

All of these companies are huge multinational organizations. Anyone who believes that they do not at times mistreat employees, try to short customers and do things detrimental to the physical Earth is mistaken. Buying shares of Calvert U.S. Large Cap Core Responsible Index Fund is not going to change that.

It is notable that the above example steers clear of big oil companies. But that does not get them off the hook by a long shot. My guess is this is mostly a marketing tool. Calvert managers can say, “we do not invest in big bad oil companies!” The people who want to believe they are doing good will nod their heads, ask no further questions, buy shares, and drive home feeling special for doing something to help society.

There are definitely companies investors should avoid: those that are largely corrupt or fraudulent. One sector that has been in the news recently is for-profit education. Companies like Devry, ITT and University of Phoenix have been selling people third-class educations financed with crippling loans for many years now. It is finally catching up to them and operations are now being shuttered, sold, or downsized.

But the basic reason to avoid something like that has nothing to do with social responsibility. It has to do with the fact that operations based around ripping people off usually do not fare so well in the long run. Those who bought ITT shares at $50 or $100 are none too happy now that it trades at .02 per share.

An investor who really wants to invest in helping the world should think about alternative technology companies. But that is risky. Many of these ideas, like solar, have lingered for decades without finding a lucrative place in the market. SunEdison’s bankruptcy is a high profile example of this. A lot of emerging technology companies do not even pay a dividend. This means if the stock does crash investors were not even getting paid to wait along the way.

Furthermore just because a company deals in green technology does not mean the people running it are saints. If you had millions of dollars of your own money invested in a company do you really think you might not pay a bribe to get a big contract that would keep the company going? Would you really not consider moving your production facility to a third world country with lower wages if it meant keeping the doors open? If you could not afford to properly dispose of manufacturing waste at your facility would you take it out into the Chinese wilderness and dump it, knowing that nobody is likely to say anything, or would you properly dispose of it and file for bankruptcy? These are difficult questions.

When it comes to investing it is better to try to live in the world, not try to change it. An investor could spend months researching the business practices of a corporation and decide they are socially responsible. The next day there might be a breaking scandal. Then what? Dump the shares while the price is down due to scandalous news? Is that not the socially responsible thing to do? It might be but that means losing money.

Companies are run by human beings and human beings have flaws. Trying to find a corporation that is a model citizen is a waste of time and energy. Avoid ones that are completely crooked, look for ones that will make money, and accept that the world is an imperfect place.

© 2016 invessentials.com – Essentials of Investing Articles presented here are general opinions for your own consideration. They are not specific advice for any one investor.

Leave a Reply Cancel reply

You must be logged in to post a comment.

Welcome Visitor!

User Options

Sections

- Account Management

- General Messages

- Insurance and Annuities

- Investment Strategy

- Market Data

- Market Timing

- Tax Matters